investment linked insurance malaysia

Maximize your returns with A-InvestLink an investment-linked insurance plan that offers benefits such as freedom to invest funds monitoring death or disability benefits and boost your investment value. SmartInvest Growth is a life insurance investment-linked plan designed to enhance your protection and financial safety net.

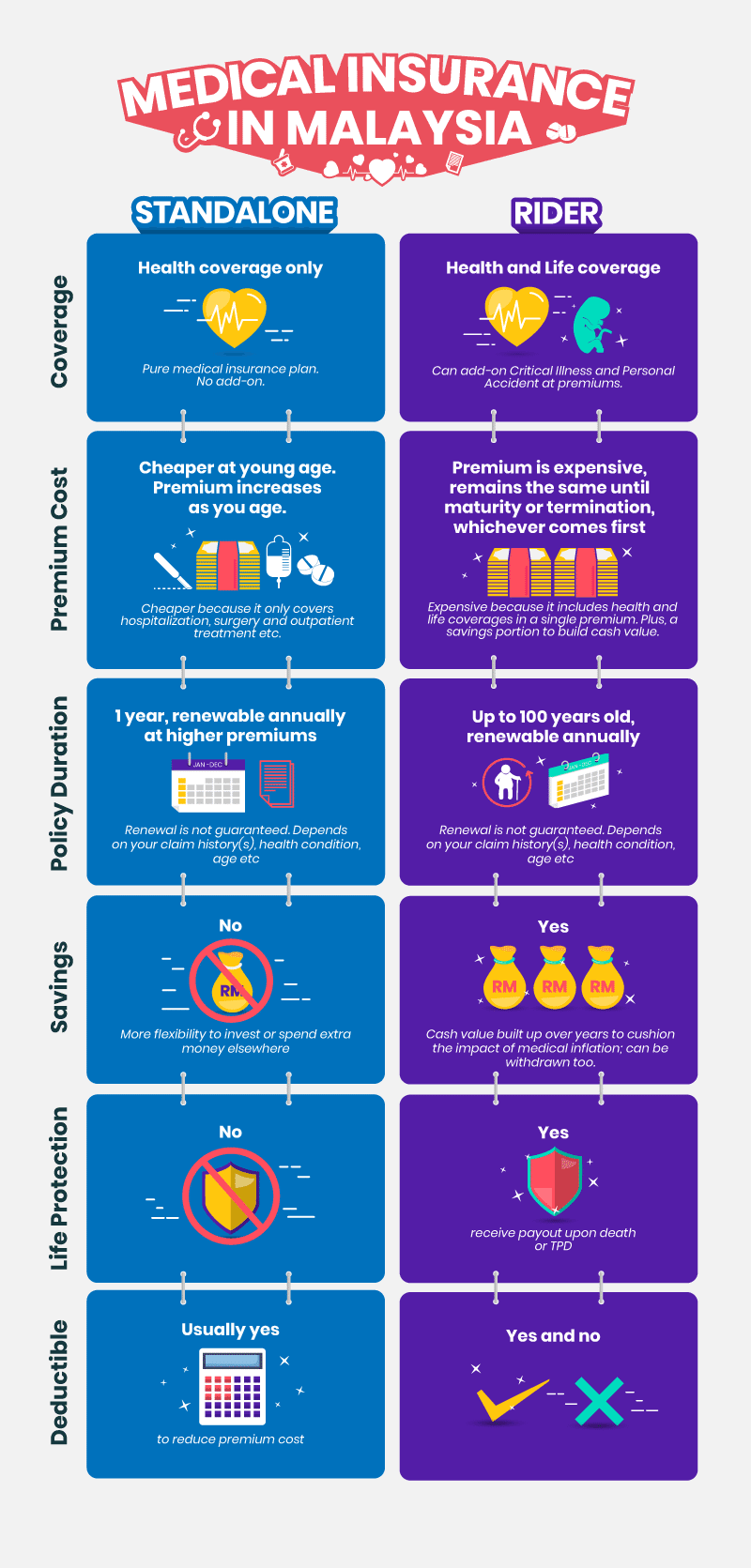

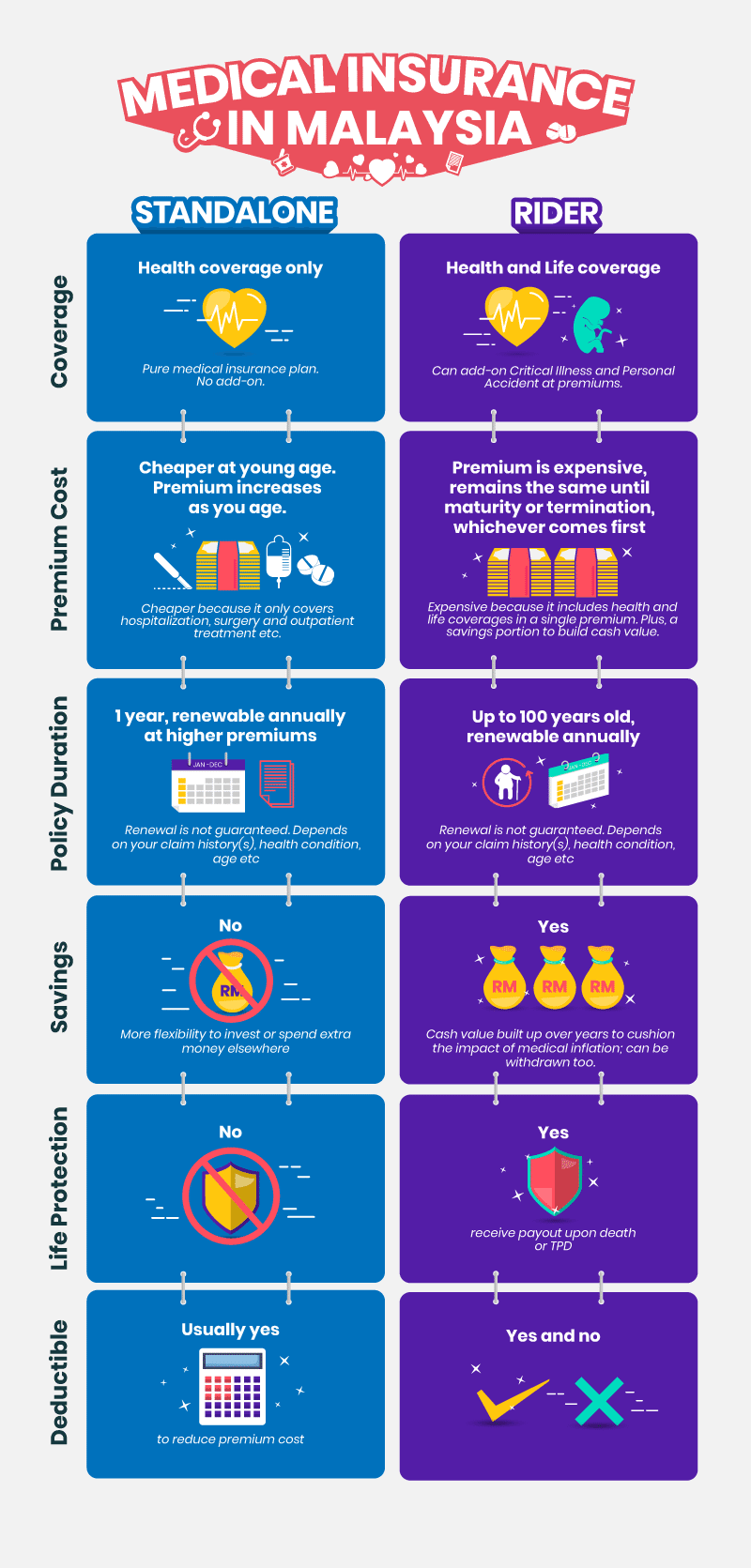

Best Standalone Medical Cards In Malaysia 2022 Compare And Buy Online

Boost your Policy Account Value and enjoy a higher payout with Prime Booster.

. To ensure that you have the sufficient knowledge and information needed before entering into a policy make sure that you have a good understanding of investment-linked insurancetakaful as well as the other miscellaneous factors that come into. Dont let this statement fool you. Our first investment-linked insurance plan with built-in CI Relief Benefit.

Lets look at some major differences between the 2 type of policies. Investment-linked InsuranceTakaful Business IL business PO880818013. The PCIL exam is a combination of Pre-Contract for Insurance Agent and Investment Linked Life Insurance examinations.

Flexible premium payment coverage terms to suit your financial situation. AIA Investment Linked Life Insurance Signature Beyond 2 The price shown is the starting monthly premium price. Regulated by Bank Negara this policy is essentially for those who are seeking to have their premiums earn some returns while insuring their health.

Guide to Investment-Linked Policy English Guide to Investment-Linked Policy BM Guide to Investment-Linked Policy Chinese. Starting with a one-time premium of just RM5000 you. The Life Insurance Association of Malaysia also recommends that you monitor your.

Covers death and total and permanent disability TPD1 up to expiry age of your choice ie. Wealth distribution directly to your nominated loved one s Long-term coverage. After passing this examination the exam candidate will have to register himselfherself with the Persatuan Insurans Am Malaysia PIAM for general insurance and Life.

And further can go on to any amount as you need subject to underwriting. This is a life insurance plan to protect your familys finances. Families or businesses seeking to protect their financial strength and financial legacies often choose.

It is an investment linked life insurance plan that provides a high financial benefit. Affordable plan with high coverage up to 3x of the Death Benefit. It even has a surrender value where you get back a portion of your savings if you intend to terminate the insurance policy.

A-Life Signature Beyond 2 is a life insurance plan from AIA Insurance Malaysia. Even though there are investment elements in it ILPs main priority is always to provide financial protection against financial catastrophe namely the. Investment-linked life insurance is paid on death permanent disability or maturity of the policy.

-Invest Link is an investment-linked plan that is designed to help you maximise the return on your investments. Smooth enrolment with permanent high Non-Medical. Investment-linked products ILPs offer a more flexible alternative for those who are concerned about their changing needs.

Opt from a wide range of investment-linked funds. The investment-linked life insurance plan starts with a higher baseline coverage amount of RM500000 and subject to a maximum of RM4 million without a medical checkup. The AIA investment linked insurance in Malaysia also has a AIA Takaful Investment Linked Insurance plan.

As we grow older the premium for an ULP medical plan PMM5 at the age 56-60 is RM 5397year whereas for the ILP the premium is RM 5451year premium was. The investment-linked plan that secures the lifestyle of your family. Find out more at AIA Malaysia today.

And b Specification pursuant to Sections 57 and 135 of the Islamic Financial Services Act 2013 IFSA on Interim Measures for Investment-linked InsuranceTakaful Business IL business JPITPT1173. Customisable protection and investment in one plan. To illustrate the insurance charges going up the premium for an ULP medical plan PMM5 at the age 21-25 is RM 1659year whereas the ILP with the same age range is RM 1726year.

44 The following requirements in this policy document will cease. Investment-linked policies offer you the possibility of promising returns while giving protection against death. These ILPs are once again coming to the forefront of insurance or Takaful plans as Bank Negara Malaysia is introducing new regulations regarding annual updates on performance of funds.

Extended assurance benefit for expiry up to age 60 70 and 80. You are advised to refer to Prudential Assurance Malaysia Berhad PAMBs Brochure Product Disclosure Sheet Product Sales Illustration Fund Fact Sheet if any and the consumer education booklet on Life Insurance Investment-Linked Insurance Personal Accident Insurance and Medical and Health Insurance before purchasing the plan and. This life insurance plan can be taken up to the age of 100 years old.

The investment linked plan ILP is an insurance plan that combines the benefit of investment and protection. Investment-Linked Insurance Policies at the Surface Investment-linked policy ILP is just as the name suggests it is an insurance policy that combines both protection and investment. Enhanced protection through optional rider.

You can top-up your investments through scheduled or single top-up or withdraw your investment in times of need. This gives everyone as they grow older the opportunity to get protected from the financial costs of. The best life insurance plan for a total coverage of life.

60 70 80 or 99. Before year 2000 there are only traditional life insurance policy available to the market. We offer products ranging from life insurance plans health plans saving plans investment-linked plans retirement plans and legacy plans that could give suit your insurance needs.

Since then some insurance companies in Malaysia had come up with many investment-linked insurance products. The plan offers a convenient way to increase your sum assured when you want more coverage due to increasing financial and family commitments at different life stages. Its easy to manage your legacy plans with flexible payment tenures of 5 10 15 or 20 years or payment tenures to match the policy term.

Investment-linked vs Traditional policy. Customisable protection and investment in one plan. Anyone who intend to pursue a career as life insurance agent.

![]()

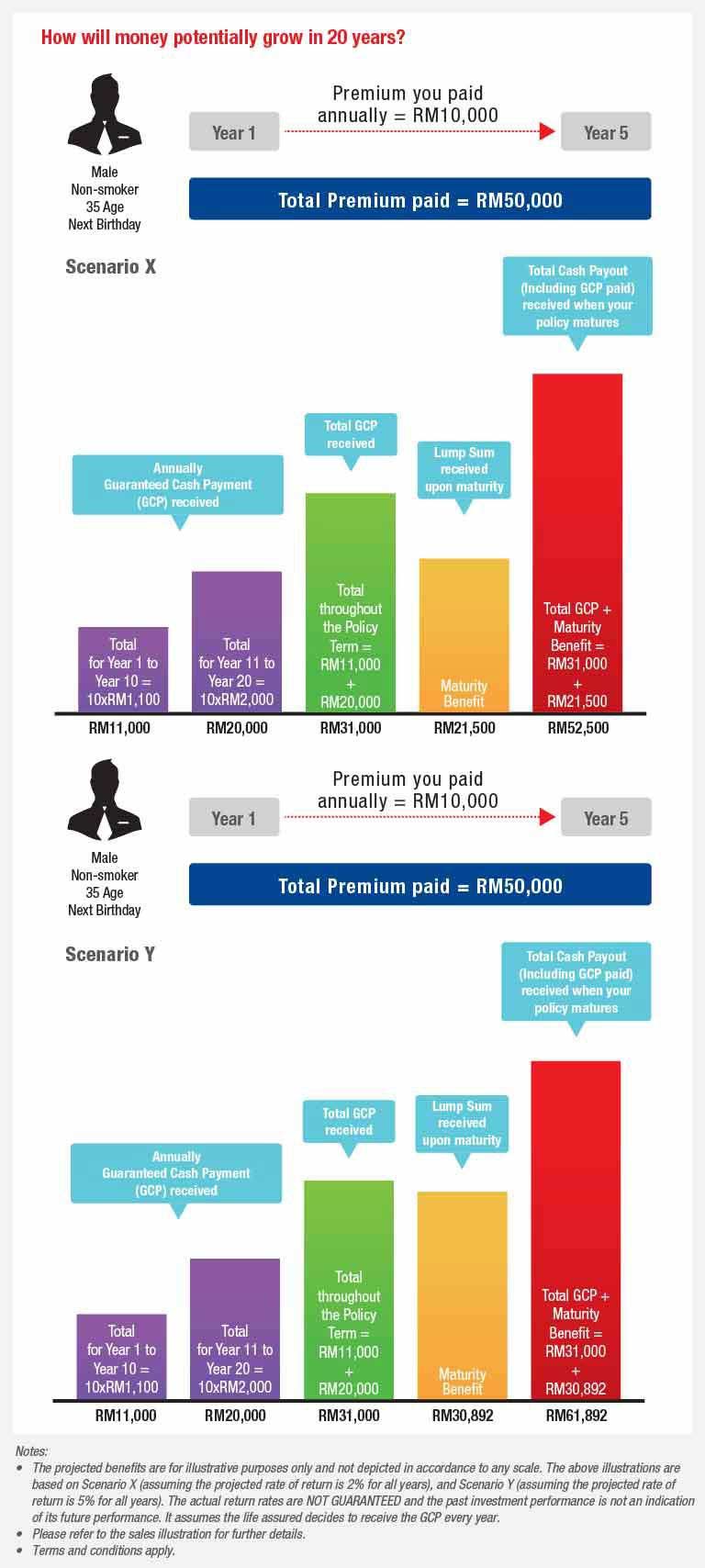

Insurance Takaful Plans For Savings And Investment Aia Malaysia

![]()

Insurance Takaful Plans For Savings And Investment Aia Malaysia

![]()

Insurance Takaful Plans For Savings And Investment Aia Malaysia

Climate Change Bank Negara Malaysia

Very Recommended If You Want To Apply Forsaving Plan Malaysia Life Insurance Malaysia Medical Card Malaysia Educa Education Plan Estate Planning How To Plan

![]()

Insurance Takaful Plans For Savings And Investment Aia Malaysia

Best Standalone Medical Cards In Malaysia 2022 Compare And Buy Online

Grow Your Wealth With Unit Trust

How To Achieve Financial Independence Retire Early Fire In Malaysia Maybank Malaysia

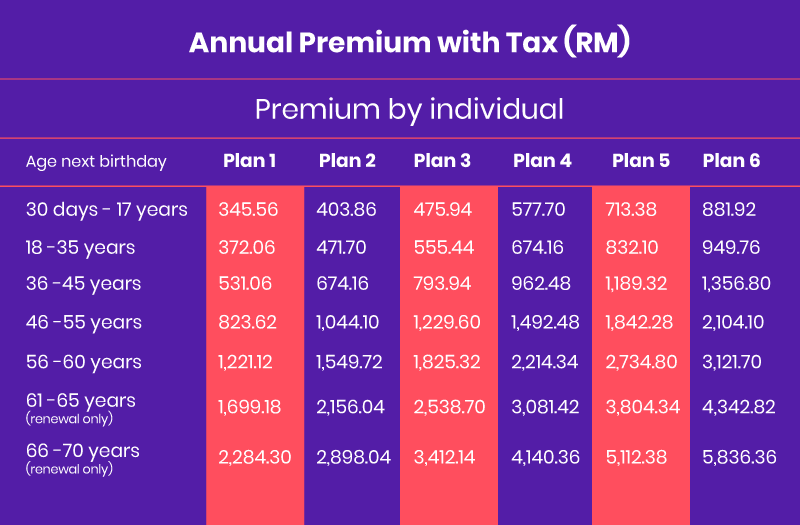

Frequently Asked Questions Life Planning Advisor Great Eastern Malaysia

Great Flexi Wealth Wealth Accumulation Great Eastern Malaysia

Bajaj Allianz Investment Plans Best Plan By Bajaj Allianz

How To Claim Income Tax Reliefs For Your Insurance Premiums

Life Insurance Company Hong Leong Assurance Malaysia

Best Investment Plan In India 2022 Top Investment Plans With High Returns

General Investment Account I Maybank Malaysia

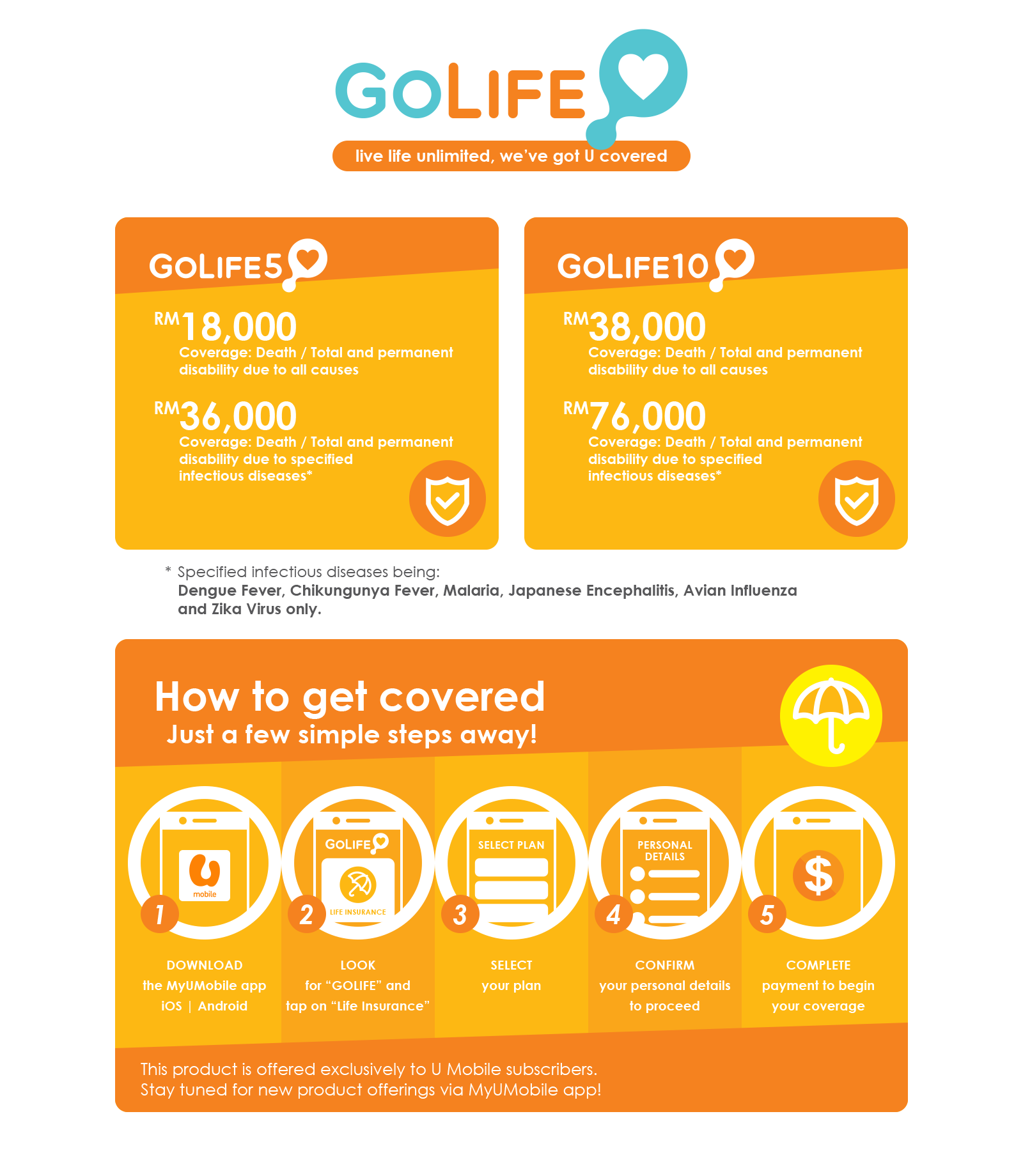

Affordable Insurance Plan For U Mobile Users Sun Life Malaysia

![]()

Insurance Takaful Plans For Savings And Investment Aia Malaysia

Best Investment Plan In India 2022 Top Investment Plans With High Returns

No comments for "investment linked insurance malaysia"

Post a Comment